Introduction to GST Accounting

GST ek tax system hai jo indirect taxes ko simplify karta hai.

In accounting books, journal entry for GST kaafi important role play karti hai.

Har business ko apne transactions record karne hote hain.

Aur unme GST ka proper entry karna zaroori hota hai.

Why Journal Entry for GST Matters

Without sahi journal entries, accounts mein errors aa sakte hain.

Aur isse tax compliance issues bhi create ho jaate hain.

Journal entry for GST ek record keeping process ko accurate banata hai.

Ye financial transparency aur audit ke liye bhi helpful hota hai.

Basic Concept of GST in Accounts

GST ke under teen major components hote hain: CGST, SGST aur IGST.

CGST aur SGST state level par lagte hain, jabki IGST interstate supply par.

Journal entry for GST ke liye hume input aur output dono consider karne padte hain.

Input tax wo hota hai jo hum kharidari par dete hain.

Output tax wo hota hai jo hum sales par customers se charge karte hain.

Dono ko reconcile karke hi final liability nikalti hai.

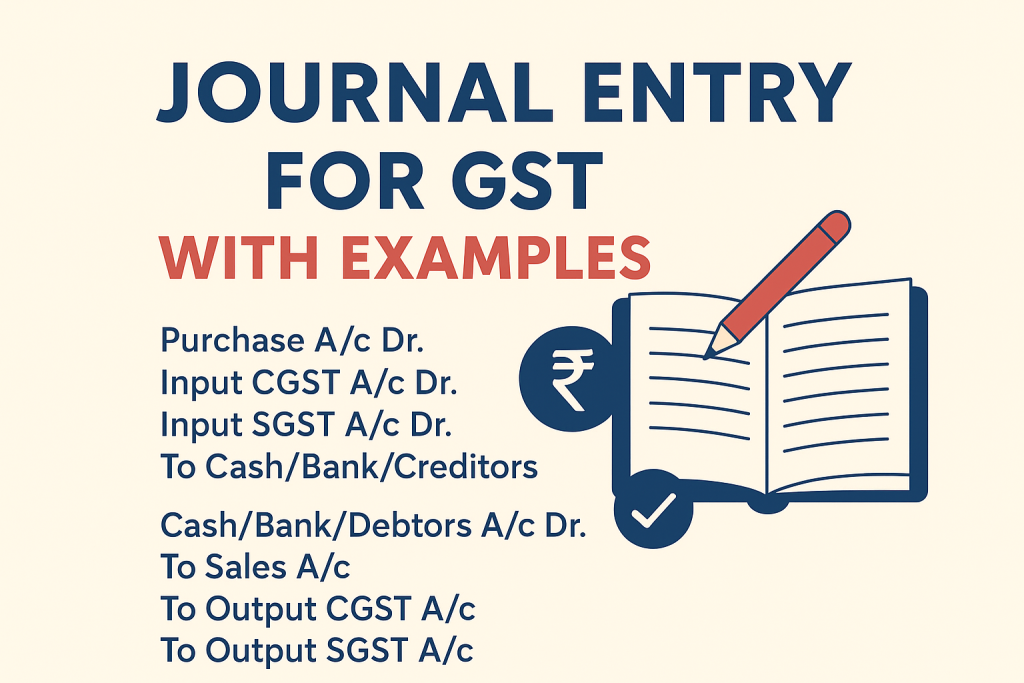

Journal Entry for GST on Purchases

Jab hum goods purchase karte hain, to hume input GST pay karna padta hai.

Is case mein entry kuch aisi hogi:

- Purchase A/c Dr.

- Input CGST A/c Dr.

- Input SGST A/c Dr.

To Cash/Bank/Creditors

Yahaan purchase account debit hota hai kyunki assets increase hote hain.

Aur input GST ko future set-off ke liye record kiya jata hai.

Journal Entry for GST on Sales

Sales ke case mein hum output GST charge karte hain.

Aur journal entry for GST is tarah hoti hai:

- Cash/Bank/Debtors A/c Dr.

To Sales A/c

To Output CGST A/c

To Output SGST A/c

Yahaan sales credit hota hai kyunki revenue generate ho raha hai.

Aur output GST liability create karta hai jo government ko dena hota hai.

Journal Entry for IGST Transactions

Jab interstate transaction hota hai tab IGST apply hota hai.

Entry kuch is tarah hogi:

- Debtors A/c Dr.

To Sales A/c

To Output IGST A/c

Similarly, purchase ke liye:

- Purchase A/c Dr.

- Input IGST A/c Dr.

To Creditors A/c

Isse dono parties ke liye GST proper tarike se record ho jata hai.

Set-off of Input and Output GST

Journal entry for GST set-off bhi zaroori hai.

Kyuki input aur output ko adjust karke hi net liability banti hai.

Agar output GST zyada hai aur input kam, to difference pay karna padta hai.

Entry hoti hai:

- Output GST A/c Dr.

To Input GST A/c

To GST Payable A/c

Agar input GST zyada hai, to carry forward ya refund ke liye claim kiya jata hai.

Journal Entry for GST Payment

Government ko GST pay karte waqt entry kuch aisi hoti hai:

- GST Payable A/c Dr.

To Cash/Bank A/c

Ye entry dikhata hai ki liability settle ho gayi hai.

Aur accounts mein proper compliance ho gaya hai.

Journal Entry for GST Refund

Kabhi kabhi input GST zyada hone par refund claim hota hai.

Entry is tarah hoti hai:

- Bank A/c Dr.

To GST Refund Receivable A/c

Isse pata chalta hai ki government ne refund process kar diya hai.

Aur company ke funds wapas aa gaye hain.

Journal Entry for GST Reverse Charge Mechanism (RCM)

RCM ek special case hai jahan buyer ko GST pay karna padta hai.

Journal entry for GST under RCM kuch is tarah hoti hai:

- Expense A/c Dr.

- Input GST A/c Dr.

To Cash/Bank A/c

Is case mein supplier GST charge nahi karta.

Buyer khud hi liability ko settle karta hai.

Journal Entry with Practical Example

Maan lijiye ek company ne ₹1,00,000 ke goods kharide.

GST rate 18% hai (9% CGST + 9% SGST).

Entry hogi:

- Purchase A/c Dr. ₹1,00,000

- Input CGST A/c Dr. ₹9,000

- Input SGST A/c Dr. ₹9,000

To Creditor A/c ₹1,18,000

Ab sales hui ₹2,00,000 ke saath 18% GST.

Entry hogi:

- Debtors A/c Dr. ₹2,36,000

To Sales A/c ₹2,00,000

To Output CGST A/c ₹18,000

To Output SGST A/c ₹18,000

Net liability = Output (₹36,000) – Input (₹18,000) = ₹18,000.

Ye amount government ko pay karna hoga.

Journal Entry for GST Adjustment in Books

Kabhi kabhi adjustment ke liye separate entries pass hoti hain.

Ye reconciliation aur annual return ke liye important hota hai.

- Output GST A/c Dr.

To Input GST A/c

Is tarah se input aur output match kiya jata hai.

Aur net payable ya refund nikalta hai.

Mistakes to Avoid in GST Journal Entries

Business owners ko kuch errors avoid karne chahiye.

Jaise wrong GST rate lagana, CGST/SGST ko confuse karna, ya IGST miss karna.

Always proper invoices maintain karein.

Aur timely reconciliation karein taaki penalties avoid ho sake.

Importance of GST Accounting Software

Manual entries kabhi kabhi time-consuming ho jaati hain.

Isliye GST-enabled accounting software use karna beneficial hota hai.

Software se accurate journal entry for GST pass hoti hai.

Aur compliance reports easily generate kiye ja sakte hain.

Conclusion

Journal entry for GST har business ke liye crucial hai.

Ye accurate accounting, transparency, aur tax compliance ensure karta hai.

Har businessman ko basic GST entries samajhni chahiye.

Aur professional help lena chahiye jab complex situations ho.

Proper GST accounting se legal issues avoid hote hain.

Aur business ki credibility market mein improve hoti hai.

5 sep 52- % 100IA

Software We Teach

Tally Prime

SAP FICO

BUSY Accounting

Quickooks

Microsoft Office

TAXMANN

Zoho

Advanced Excel

Business Reporting

Share Trading

Technical Analysis

Power BI

Our Students Placed In

Join! Job Oriented Diploma Courses

- 12 Months Practical Training

- 100% Job Guarantee

- 24/7 LMS Access

- Online & Classroom Training

- Diploma Certificate

- 15 Months Practical Training

- 100% Job Guarantee

- 24/7 LMS Access

- Online & Classroom Training

- Diploma Certificate

- 18 Months Practical Training

- 100% Job Guarantee

- 24/7 LMS Access

- Online & Classroom Training

- Diploma Certificate

- 6 Months Practical Training

- 100% Job Guarantee

- 24/7 LMS Access

- Online & Classroom Training

- Diploma Certificate

- 2 Months Practical Training

- 100% Job Guarantee

- 24/7 LMS Access

- Online & Classroom Training

- Diploma Certificate

- 12 Months Practical Training

- 100% Job Guarantee

- 24/7 LMS Access

- Online & Classroom Training

- Diploma Certificate

- 3 Months Practical Training

- 100% Placement Assistance

- 24/7 LMS Access

- Online & Classroom Training

- Diploma Certificate

- 5 Months Practical Training

- 100% Placement Assistance

- 24/7 LMS Access

- Online & Classroom Training

- Diploma Certificate

- 6 Months Practical Training

- 100% Placement Assistance

- 24/7 LMS Access

- Online & Classroom Training

- Diploma Certificate

- 2 Months Practical Training

- 100% Job Placement

- 24/7 LMS Access

- Online & Classroom Training

- Diploma Certificate

- 2 Months Practical Training

- 100% Placement Assistance

- 24/7 LMS Access

- Online & Classroom Training

- Diploma Certificate

- 3 Months Practical Training

- 100% Placement Assistance

- 24/7 LMS Access

- Online & Classroom Training

- Diploma Certificate

- 2 Months Practical Training

- 100% Job Placement

- 24/7 LMS Access

- Online & Classroom Training

- Diploma Certificate

- 12 Months Practical Training

- 100% Job Guarantee

- 24/7 LMS Access

- Online & Classroom Training

- Diploma Certificate

- 6 Months Practical Training

- 100% Placement Assistance

- 24/7 LMS Access

- Online & Classroom Training

- Diploma Certificate

How Can I Get Job ?

Fill Enquiry Form

Attend Classes

Get 100% Job

Diploma Certificate