FAQ’s on Tally Prime Course

FAQ 1: क्या Tally Prime course क्या होता है और इसका purpose क्या है?

Tally computer course एक professional accounting training program होता है जो business accounting सिखाता है.

यह course students को computerized accounting system समझने में help करता है clearly.

Students ledger creation, voucher entry, और report generation सीखते हैं practically.

Therefore, learners real business accounting efficiently handle कर सकते हैं independently.

FAQ 2: क्या Tally Training beginners के लिए सही है?

Yes, Tally course beginners के लिए completely suitable होता है.

Institute training basic concepts से start होती है step-by-step.

Students accounting knowledge gradually develop करते हैं confidently.

Therefore, beginners आसानी से accounting expert बन सकते हैं.

FAQ 3: क्या Tally Prime सीखने के लिए accounting background जरूरी है?

No, accounting background mandatory नहीं होता learning के लिए.

Institute accounting concepts basic level से explain करता है clearly.

Students बिना commerce background भी आसानी से सीख सकते हैं.

Learning process simple और structured होता है always.

Course syllabus accounting fundamentals और software training cover करता है completely.

Students company creation, ledger, voucher entry, GST, और reports सीखते हैं.

Advanced topics payroll और taxation भी include होते हैं.

This ensures complete accounting knowledge development.

FAQ 6: क्या Tally computer course practical based होता है?

Yes, course practical training focused होता है skill development के लिए.

Students real business examples पर practice करते हैं regularly.

Hands-on training confidence improve करता है significantly.

This prepares students for real job environment.

FAQ 7: क्या Tally course certificate provide करता है?

Yes, institute course completion certificate provide करता है students को.

Certificate skill validation और credibility improve करता है professionally.

Employers certified candidates prefer करते हैं hiring process में.

This improves job opportunities significantly.

FAQ 8: क्या Tally Prime course job के लिए useful है?

Yes, this course accounting job opportunities increase करता है strongly.

Companies skilled accounting professionals hire करते हैं regularly.

Students accountant, executive, या assistant roles achieve कर सकते हैं.

Career growth opportunities expand होती हैं significantly.

FAQ 9: क्या Tally Training students और working professionals दोनों के लिए useful है?

Yes, course students और professionals दोनों के लिए beneficial होता है.

Students career start कर सकते हैं accounting field में easily.

Working professionals skills upgrade करके promotion achieve कर सकते हैं.

This improves career growth opportunities greatly.

FAQ 10: क्या Tally Program GST accounting सिखाता है?

Yes, GST accounting training course में fully included होती है.

Students GST entries, reports, और returns preparation सीखते हैं practically.

GST knowledge accounting career में essential skill होती है today.

This improves employability and professional competence.

FAQ 11: क्या Tally Software small business owners के लिए useful है?

Yes, business owners accounting independently manage कर सकते हैं after training.

They can track income, expenses, और profit easily.

Financial control improve होता है significantly.

Business efficiency increase होती है continuously.

FAQ 12: क्या Tally course future career secure करता है?

Yes, accounting skill evergreen career option होता है always.

Every business accounting professionals require करता है continuously.

Demand stable रहती है industries में consistently.

Career security strong रहती है long-term.

FAQ 13: क्या Tally course easy to learn है?

Yes, software user-friendly interface provide करता है beginners के लिए.

Institute training concepts simple तरीके से explain करता है clearly.

Practice learning speed improve करता है significantly.

Students जल्दी confidence develop करते हैं.

FAQ 14: क्या Tally accounting fundamentals strong करता है?

Yes, course accounting fundamentals deeply explain करता है clearly.

Students debit, credit, और transaction recording सीखते हैं properly.

Strong foundation career growth improve करता है significantly.

Professional competence increase होती है gradually.

FAQ 15: क्या Tally offline और online दोनों modes में available है?

Yes, course offline और online दोनों modes में available होता है.

Students अपनी convenience के अनुसार mode select कर सकते हैं.

Both modes practical training provide करते हैं effectively.

Learning outcome same रहता है दोनों formats में.

FAQ 16: क्या Tally Course करने के बाद fresher job मिल सकती है?

Yes, freshers accounting jobs easily secure कर सकते हैं after course completion.

Companies entry-level accountant positions offer करते हैं regularly.

Skills employment opportunities improve करते हैं significantly.

Career start smooth हो जाता है.

FAQ 17: क्या Tally Prime salary improve करने में help करता है?

Yes, accounting skills salary growth improve करते हैं significantly.

Experienced professionals higher salary packages receive करते हैं.

Skill upgrade earning potential increase करता है strongly.

Career advancement faster होता है.

FAQ 18: क्या Tally Prime certification important होता है career के लिए?

Yes, certification professional credibility improve करता है significantly.

Employers certified candidates preference देते हैं hiring में.

Certification resume value increase करता है strongly.

Job selection chances improve होते हैं.

FAQ 19: क्या Tally course accounting career start करने के लिए sufficient है?

Yes, this course accounting career strong foundation provide करता है.

Students accounting roles confidently start कर सकते हैं.

Experience gradually expertise improve करता है significantly.

Career growth opportunities increase होती हैं continuously.

FAQ 20: क्या Tally Online course long-term career growth provide करता है?

Yes, accounting field long-term career stability provide करता है always.

Professionals higher roles achieve कर सकते हैं with experience.

Career progression strong और consistent रहता है.

Financial growth opportunities increase होती हैं steadily.

FAQ 21: क्या Tally Prime course करने के बाद freelancing opportunities मिलती हैं?

Yes, freelancing opportunities बहुत strong होती हैं after completing Tally course.

Many small businesses freelance accountants को hire करते हैं monthly accounting work के लिए.

आप GST return filing, bookkeeping, and payroll services independently offer कर सकते हैं.

Freelancing income ₹5,000 to ₹50,000 monthly तक grow हो सकता है gradually.

FAQ 22: क्या Tally Prime commerce students के लिए ही useful है?

No, this course commerce students तक limited नहीं है.

Science और arts students भी accounting skills easily सीख सकते हैं.

Basic concepts institute में simple तरीके से explain किए जाते हैं.

Therefore, any student career accounting field में build कर सकता है.

FAQ 54: क्या Tally Prime सीखने के लिए maths strong होना जरूरी है?

No, advanced mathematics knowledge required नहीं होती accounting सीखने के लिए.

Basic addition, subtraction, and percentage understanding sufficient होती है.

Software calculations automatically perform करता है internally.

Therefore, maths weak students भी comfortable feel करते हैं.

FAQ 55: क्या Tally course job guarantee देता है?

Institute training provide करता है but job guarantee depend करती है skills पर.

However, placement assistance और interview preparation provided होता है.

Students practical knowledge develop करके easily job secure करते हैं.

Employers skilled candidates को prefer करते हैं always.

FAQ 57: क्या Tally Prime course GST return filing सिखाता है?

Yes, GST return filing complete process practically सिखाया जाता है.

Students GST entries, reports, and filing procedure सीखते हैं clearly.

Real-world scenarios practice कराए जाते हैं regularly.

This improves confidence and professional readiness.

FAQ 59: क्या Tally Prime course salary increase करने में मदद करता है?

Yes, skilled professionals higher salary packages receive करते हैं.

Employers experienced candidates को higher compensation offer करते हैं.

Skills upgrade career growth accelerate करता है effectively.

This improves earning potential significantly.

FAQ 60: क्या Tally Prime course practical based होता है?

Yes, practical training major component होता है course का.

Students real business transactions practice करते हैं regularly.

Hands-on experience skill development improve करता है strongly.

This ensures job readiness immediately.

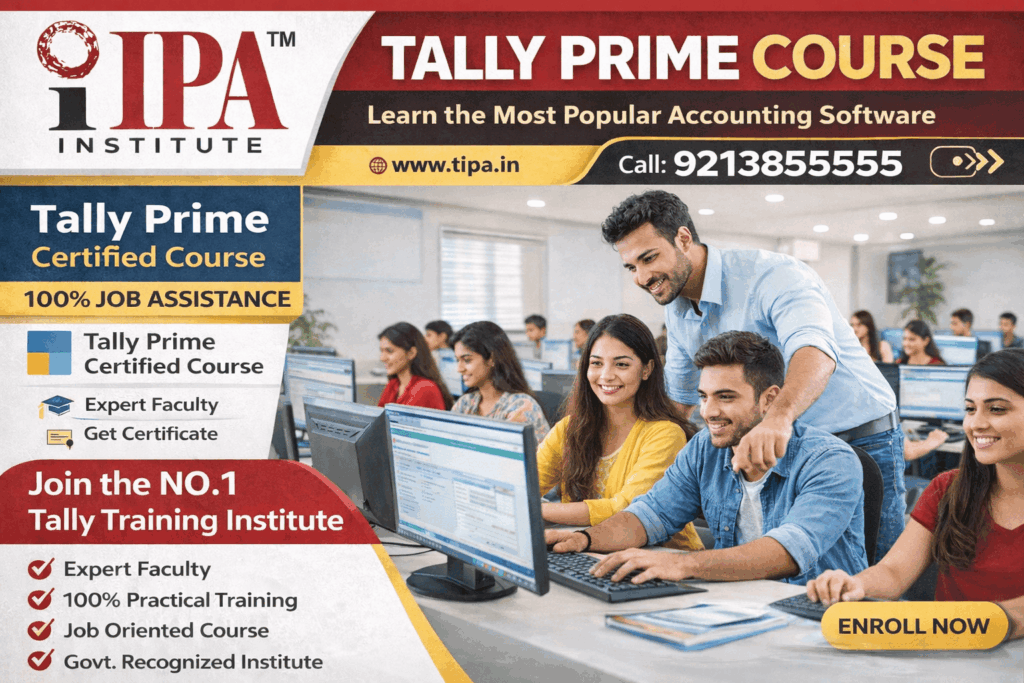

Best Tally Prime Course Training Institute in Delhi NCR

The Institute of Professional Accountants – 92138-55555

E 54 Main Vikas Marg , Laxmi Nagar Delhi -92 Near Hira Sweets, Delhi 110092, India

Well-rated centre focusing on Tally software training, accounting & practical modules.

IPA Tally Training Institute – 9212008787

54 Main Vikas Marg , Laxmi Nagar Delhi -92 Near Hira Sweets, Delhi 110092, India

Well-rated centre focusing on Tally software training, accounting & practical modules.

Best Tally & Gst Training Institute 9810083990

1st Floor, Double Storey, 16/2A, Street Number 4, near Metro Station Tilak Nagar Highly rated for Tally ERP & GST training with hands-on classes.

Tally Course in Delhi | GST & Accounting Training Institute

14/11, Tilak Nagar, New Delhi, Delhi 110058, India

Focuses on Tally Prime, accounting, and GST modules.

Tally’s E Accounting Training Institute in Delhi

14, 2nd Floor, Near Metro Station, Tilak Nagar, Delhi, 110058, India

Provides Tally ERP + GST + e-Accounting practical classes.

Tally Academy® Regd. Under Govt. of NCT of Delhi

17A, Seelampur, Shahdara, Delhi, 110031, India

Government-registered accounting & Tally training institute with positive reviews.

IACI – Tally Institute of Learning

250 1st Floor, Kingsway Camp, GTB Nagar, New Delhi, Delhi 110033, India

Authorized Tally training & certification centre covering Tally Prime & GST.

TALLY GST INSTITUTE (LAXMI NAGAR)

Kalra Complex, U-76, Shakarpur, New Delhi, Delhi 110092, India

Training in Tally ERP, GST, advanced Excel & accounting modules.

Best Tally GST Training Academy in Delhi

c-6, 4th Floor, Malviya Nagar, Delhi 110017, India

Offers Tally Prime & GST with practical accounting exercises.

Institute Of Tally Learning‑Authorized Tally Academy

40 4th Floor, North Commercial Complex, Gopal Nagar, Azadpur, Delhi, 110033, India

Dedicated tally learning centre with certification preparation.

CADD TALLY HUB INSTITUTE

2nd Floor, U-17 , Street Number 4, Near Laxmi Nagar, Delhi, 110092, India

Popular training hub with large student base and practical focus.